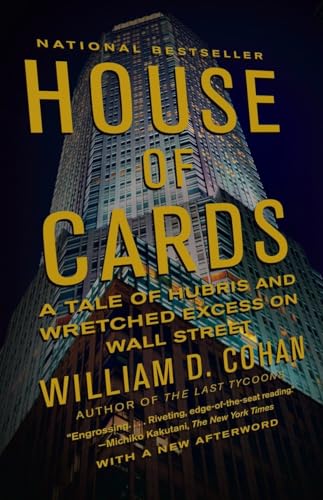

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street - Softcover

At the beginning of March 2008, the monetary fabric of Bear Stearns, one of the world’s oldest and largest investment banks, began unraveling. After ten days, the bank no longer existed, its assets sold under duress to rival JPMorgan Chase. The effects would be felt nationwide, as the country suddenly found itself in the grip of the worst financial mess since the Great Depression. William Cohan exposes the corporate arrogance, power struggles, and deadly combination of greed and inattention, which led to the collapse of not only Bear Stearns but the very foundations of Wall Street.

"synopsis" may belong to another edition of this title.

Sedacca, the forty--eight--year--old president of Atlantic Advisors, a $3.5 billion investment management company and hedge fund, had been watching his Bloomberg screens on a daily basis as the cost of insuring the short--term obligations–known in Wall Street argot as "credit default swaps"–of both Lehman and Bear Stearns had increased steadily since the summer of 2007 and then more rapidly in February 2008. Now he was calling the end of the credit party that had been raging on Wall Street for six years. "I've been talking about it for years," Sedacca said later. "But I started to notice it that fall. Because if you think about it, if you have all this nuclear waste on your balance sheet, what are you supposed to do? You're supposed to cut your dividends, you're supposed to raise equity, and you're supposed to shrink your balance sheet. And they did just the opposite. They took on more leverage. Lehman went from twenty--five to thirty--five times leveraged in one year. And then they announce a big stock buyback at $65 a share and they sell stock at $38 a share. I mean, they don't know what they're doing. And yet they get rewarded for doing that. It makes me sick."

Sedacca had witnessed firsthand a few blowups in his day. He worked at the investment bank Drexel Burnham Lambert–the former home of junk--bond king Michael Milken–when it was liquidated in 1990 and lost virtually overnight the stock he had in the firm as it plunged from $110 per share to zero (Drexel was a private company but the stock had been valued for internal purposes). "It was enough that it stunned," he explained. "It was more than a twenty--nine--year--old would want to lose." Many of his Drexel colleagues had taken out loans from Citibank to buy the Drexel stock and were left with their bank loans and worthless stock. "I know people with millions and millions of dollars of debt and the stock was at zero," he said. They either paid off the loans or declared personal bankruptcy. "That's what happens when everyone turns off your funding," he added.

He then moved on to Kidder Peabody and watched that 130--year--old firm disintegrate, too. As a result of these experiences and those at other Wall Street firms, he had developed a healthy skepticism of both debt and the ways of Wall Street. Starting in the summer of 2007, he began to feel certain that the mountain of debt building across many sectors of the American economy would not come to a good end. He started betting against credit. "I've watched enough screens long enough to know something was wrong," he said.

The problem at Bear Stearns and Lehman Brothers, Sedacca informed his clients and Minyanville readers, was that both firms had huge inventories on their balance sheets of securities backed by home mortgages. The rate of default on these mortgages, while still small, was growing at the same time that the value of the underlying collateral for the mortgage–people's homes–was falling rapidly. Sedacca could not help noticing that the effects of this double whammy were beginning to show up in other, smaller companies involved in the mortgage industry. He could watch the noose tighten in the credit markets. "Look at what is happening to Thornburg Mortgage," he wrote, referring to the publicly traded home mortgage lender, which specialized in making what were known as "Alt--A" mortgages, those greater than $417,000, to wealthy borrowers. Thornburg had been "overwhelmed" by margin calls from its lenders. "It supposedly only has a 0.44% default rate on its [$24.7 billion] mortgage portfolio that it services but the bonds it owns are getting pounded. Result? Margin call. The worst part is that the company went to sell some bonds to settle the margin calls but couldn't. The ultimate Roach Motel."

That Thornburg, based in Sante Fe, New Mexico, appeared to be hitting the wall was somewhat surprising considering its customers' low default rate and high credit quality. The problem at Thornburg was not that its customers could no longer pay the interest and principal on their mortgages; the problem was that the company could no longer fund its business on a day--to--day basis. Thornburg had a liquidity problem because its lenders no longer liked the collateral–those jumbo mortgages–Thornburg used to obtain financing.

Unlike a bank, which is able to use the cash from its depositors to fund most of its operations, financial institutions such as Thornburg as well as pure investment banks such as Lehman Brothers and Bear Stearns had no depositors' money to use. Instead they funded their operations in a few ways: either by occasionally issuing long--term securities, such as debt or preferred stock, or most often by obtaining short--term, often overnight, borrowings in the unsecured commercial paper market or in the overnight "repo" market, where the borrowings are secured by the various securities and other assets on their balance sheets. These fairly routine borrowings have been repeated day after day for some thirty years and worked splendidly–until there was perceived to be a problem with either the securities or the institutions backing them up, and then the funding evaporated like rain in the Sahara. The dirty little secret of what used to be known as Wall Street securities firms–Goldman Sachs, Morgan Stanley, Merrill Lynch, Lehman Brothers, and Bear Stearns–was that every one of them funded their business in this way to varying degress, and every one of them was always just twenty--four hours away from a funding crisis. The key to day--to--day survival was the skill with which Wall Street executives managed their firms' ongoing reputation in the marketplace.

Thornburg financed its operations very similarly to the way investment banks did. But in mid--February 2008, Thornburg was having a very difficult time managing its perception in the marketplace because its short--term borrowings were backed by the mortgages it held on its balance sheet. Some of these mortgages were prime mortgages, money lent to the lowest--risk borrowers, and some were those Alt--A mortgages, which were marginally riskier than prime mortgages and offered investors higher yields. At Thornburg, 99.56 percent of these mortgages were performing just fine.

But that did not matter. What mattered was that the perception of these mortgage--related assets in the market was deteriorating rapidly. That perception spelled potential doom for firms such as Thornburg, Bear Stearns, and Lehman Brothers, which financed their businesses in the overnight repo market using mortgage--related assets as collateral.

For Thornburg the trouble began on February 14, halfway around the world, when UBS, the largest Swiss bank, reported a fourth--quarter 2007 loss of $11.3 billion after writing off $13.7 billion of investments in U.S. mortgages. Amid this huge write--off, UBS said it had lost $2 billion on Alt--A mortgages and, worse, that it had an additional exposure of $26.6 billion to them. In a letter to shareholders before he lost his job on April 1, Marcel Ospel, UBS's longtime chairman, wrote that the year 2007 had been "one of the most difficult in our history" because of "the sudden and serious deterioration in the U.S. housing market."

UBS's sneeze meant that Thornburg, among others, caught a major cold. By writing down the value of its Alt--A mortgages, UBS forced other players in the market to begin to revalue the Alt--A mortgages on their books. Since these were the very assets that Thornburg (and Bear Stearns) used as collateral for its short--term borrowings, soon after February 14 the company's creditors made margin calls "in excess of $300 million" on its short--term borrowings. At first, Thornburg used what cash it had to meet the margin calls. But that did not stop the worries of its creditors. "After meeting all of its margin calls as of February 27, 2008, Thornburg Mortgage saw further continued deterioration in the market prices of its high quality, primarily AAA--rated mortgage securities," the company wrote in a March 3 filing with the SEC. This new deterioration of the value of its prime mortgages resulted in new margin calls of $270 million–among them $49 million from Morgan Stanley, $28 million from JPMorgan on February 28, and $54 million from Goldman Sachs.

This time, though, Thornburg was "left with limited available liquidity" to meet the new margin calls or any future margin calls. From December 31, 2007, to March 3, 2008, Thornburg received margin calls totaling $1.777 billion and was able to satisfy only $1.167 billion of them, or about 65 percent–a dismal performance. The balance of $610 million "significantly exceeded its available liquidity," the company announced on March 7. "These events have raised substantial doubt about the Company's ability to continue as a going concern without significant restructuring and the addition of new capital." The company's stock, which had traded for more than $28 per share in May 2007, closed at $4.32 on March 3, 2008, down 51 percent on the day. "The turmoil in the mortgage financing market that began last summer continues to be exacerbated by the mark--to--market accounting rules which are forcing companies to take unrealized write--downs on assets they have no intention of selling," explained Larry Goldstone, Thornburg's CEO. By March 10, Thornburg's stock was trading at 69¢ per share.

Goldstone's explanation of what was happening at his company was merely a heavily lawyered version of what Sedacca referred to as the "ultimate Roach Motel." A vicious cycle of downward pressure on the value of mortgage securities, which had begun at least a year earlier, was reaching a crescendo and affecting the entire asset class, not just the most junior and riskiest mortgages–so--called subprime mortgages–but also the more secure, performing mortgages. The very word "mortgage" was now a synonym for "toxic waste," or, as one wag wrote, "Financial Ebola."

To be sure, other firms were having serious mortgage--related problems, too. "I realized the market in general was far worse than I had imagined," Goldstone told the Washington Post in December 2008. "If UBS had that much, what about Goldman? What about Citi? What about everyone else?" For instance, there was Peloton Partners, a high--flying $1.8 billion hedge fund started in June 2005 by Ron Beller, a Goldman Sachs alumnus. Beller had become well known in financial circles a few years earlier when his secretary at Goldman Sachs stole £4.3 million from him and his partner, Scott Mead, without them realizing it. Before the secretary was convicted, Beller told the jury that he suspected something was amiss when he noticed his bank account was "one or two million light." In 2007, Peloton's asset--backed securities fund returned 87 percent to investors and was named the best fixed--income fund of the year by EuroHedge magazine. But the fund closed in February 2008 after its investments in Alt--A mortgages fell precipitously in the wake of the UBS announcement about its write--downs on February 14–the same announcement that caused Thornburg's problems. Like Thornburg, Peloton faced repeated margin calls from its Wall Street lenders, but unlike Thornburg, Peloton ran out of cash to meet those calls before a rescue plan could be implemented. Beller lost $60 million personally.

Beller's problems had a viral effect on Wall Street. His fund's collapse had the misfortune of occurring on Leap Day, February 29. In another year, the fund would have collapsed on March 1, the beginning of the second quarter. Instead, the collapse came at the end of the first quarter. The new valuation in the market of the securities Peloton owned meant that Wall Street firms such as Bear Stearns had to take into consideration these new marks for their own like securities and reflect those marks in their first--quarter numbers. Since Bear was hoping to show the market that it would have a profit during the first quarter of 2008, the Peloton collapse caused the firm to reevaluate just how profitable it was.

"February 29 was the day Peloton blew up," explained Paul Friedman, a Bear senior managing director and the chief operating officer of the fixed--income division, "and so you had a huge liquidation, us and others, of really high--quality stuff that went at really distressed prices. There were a lot of rumors of that being on dealers' balance sheets, that they couldn't sell it, and we were for once the first out and we got rid of all of it. So you've now got a really serious amount of high--quality paper, and reasonably high--quality counterparties–the whole Peloton thing. This was fund of the year in 2007. Ten weeks later, you're out of business. You've now got a data point. Everybody, at least at our firm and I think at the other firms, is looking on February 29, 'Okay, where are we going to mark our stuff?' because this is now a liquidation. You mark to where you blew out Peloton, which is going to be huge losses, where you couldn't even blow them out the following week. It was sort of the beginning of the end."

Born in Schenectady, New York, Friedman graduated from Colgate University in 1977 with a degree in economics. He then headed off to one of the Big Eight accounting firms, as they were then known, and ended up auditing Drexel Burnham, the last major Wall Street firm to blow up before Bear Stearns. He figured he knew something about Wall Street as a result and applied for the wrong job–something to do with mortgage--backed securities, which he knew nothing about– at Bear Stearns in March 1981. By serendipity, as he was leaving his botched interview, he heard about another job in the operations department and accepted it on the spot. He did that for a while but disliked being in the back office. One day he told his boss that he hated his job. "About an hour later, I was interviewing for a job on the trading desk," he said, "and then moved to being a trading assistant, and then ultimately to a trader on the mortgage desk in the very early days of mortgage--backed securities. Did that for a couple of years, and was a highly, highly mediocre trader." Soon he was the assistant to the guy running the fixed--income department, a job he held for the next twenty years even as the person who ran the department changed often during that time period.

Another clear sign of trouble, along with the margin--call messes at Thornburg and at Peloton, were margin calls being made in Amsterdam against a seven--month--old publicly traded $22 billion hedge fund controlled by the Carlyle Group, the Washington--based investment firm with $81 billion under management run by David Rubinstein. Carlyl...

"About this title" may belong to another edition of this title.

- PublisherKnopf Doubleday Publishing Group

- Publication date2010

- ISBN 10 0767930894

- ISBN 13 9780767930895

- BindingPaperback

- Number of pages608

- Rating

Buy New

Learn more about this copy

Shipping:

FREE

Within U.S.A.

Top Search Results from the AbeBooks Marketplace

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street by Cohan, William D. [Paperback ]

Book Description Soft Cover. Condition: new. Seller Inventory # 9780767930895

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street

Book Description Condition: New. Book is in NEW condition. Seller Inventory # 0767930894-2-1

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street

Book Description Condition: New. New! This book is in the same immaculate condition as when it was published. Seller Inventory # 353-0767930894-new

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street (Paperback or Softback)

Book Description Paperback or Softback. Condition: New. House of Cards: A Tale of Hubris and Wretched Excess on Wall Street 1. Book. Seller Inventory # BBS-9780767930895

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street

Book Description Condition: New. Seller Inventory # ABLIING23Feb2416190171228

House of Cards : A Tale of Hubris and Wretched Excess on Wall Street

Book Description Condition: New. Seller Inventory # 6634202-n

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street

Book Description Paperback. Condition: new. New. Fast Shipping and good customer service. Seller Inventory # Holz_New_0767930894

House of Cards (Paperback)

Book Description Paperback. Condition: new. Paperback. A blistering narrative account of the negligence and greed that pushed all of Wall Street into chaos and the country into a financial crisis. At the beginning of March 2008, the monetary fabric of Bear Stearns, one of the worlds oldest and largest investment banks, began unraveling. After ten days, the bank no longer existed, its assets sold under duress to rival JPMorgan Chase. The effects would be felt nationwide, as the country suddenly found itself in the grip of the worst financial mess since the Great Depression. William Cohan exposes the corporate arrogance, power struggles, and deadly combination of greed and inattention, which led to the collapse of not only Bear Stearns but the very foundations of Wall Street. Written with the novelistic verve and insider knowledge that made "The Last Tycoons" a bestseller, "House of Cards" is a chilling cautionary tale about greed, arrogance, and stupidity in the financial world. Shipping may be from multiple locations in the US or from the UK, depending on stock availability. Seller Inventory # 9780767930895

House of Cards A Tale of Hubris and Wretched Excess on Wall Street

Book Description PAP. Condition: New. New Book. Shipped from UK. THIS BOOK IS PRINTED ON DEMAND. Established seller since 2000. Seller Inventory # IQ-9780767930895

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street

Book Description Paperback. Condition: new. New Copy. Customer Service Guaranteed. Seller Inventory # think0767930894